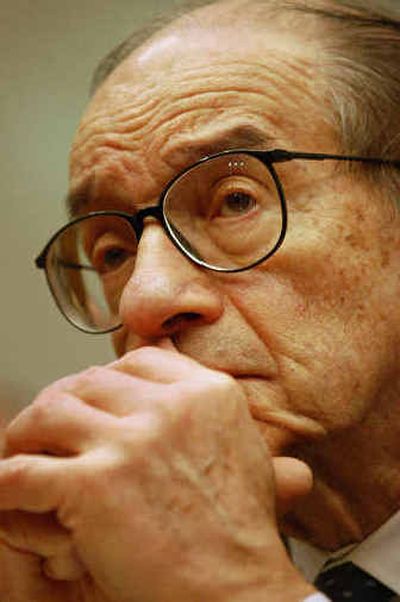

Budget deficit poses risks, Greenspan says

WASHINGTON — Federal Reserve Chairman Alan Greenspan said Thursday that future budget deficits pose a bigger risk to the economy than record trade imbalances and the country’s extremely low savings rate.

In a wide-ranging speech, Greenspan said he believed the United States’ flexible economy would be able to deal with current concerns over trade and savings.

“The resolution of our current account deficit and household debt burdens does not strike me as overly worrisome, but that is certainly not the case for our fiscal deficit,” Greenspan said in prepared remarks to the Council on Foreign Relations in New York.

A copy of his remarks was distributed in Washington.

The Fed chief said the budget deficit is a problem because it is projected to rise significantly as a wave of baby boomers start to retire in 2008.

“Our fiscal prospects are, in my judgment, a significant obstacle to long-term stability,” Greenspan said.

Greenspan has been steadily beating the drum about the urgent need for policy-makers on Capitol Hill and the White House to get the nation’s fiscal house in order.

While Greenspan has endorsed President Bush’s move to set up personal investment accounts as part of an overhaul of Social Security, he has called for a go-slow approach to setting up such accounts. His concern is that massive government borrowing to bring them about could push up interest rates.

Greenspan also suggested that benefit cuts would be required to deal with looming funding problems within Social Security.

“What we know for sure, however, is that the 30 million baby boomers who will reach 65 years of age over the next quarter century are going to place enormous pressures on the ability of our economy to supply the real benefits promised to retirees under current law,” Greenspan said.

On trade, Greenspan expressed hope that further declines in the value of the U.S. dollar would narrow the trade deficit, which mushroomed to an all-time high of $617 billion in 2004.

A weaker dollar makes U.S. exports less expensive to foreign buyers and thus more competitive on overseas markets. A weaker dollar also can raise the prices of imported goods flowing into the United States.

Greenspan said it would have been impossible a few decades ago to even fund a trade deficit the size of the current one in the United States because global investment flows wouldn’t have been sufficient.

As he did in a November speech, Greenspan forecast that at some point foreigners — who are currently financing U.S. trade deficits by buying dollar-demoninated assets — will lose some of their appetite for U.S. investments.

But Greenspan said such a scenario is likely to occur in an orderly fashion without disrupting the U.S. economy.

Citing two studies done by the Federal Reserve, Greenspan said “market forces are likely to restore a more long-term sustainable current account balance here without substantial disruption.”

On other issues, Greenspan repeated his belief that sharply rising home prices in recent years do not constitute a national bubble.